Economic Security

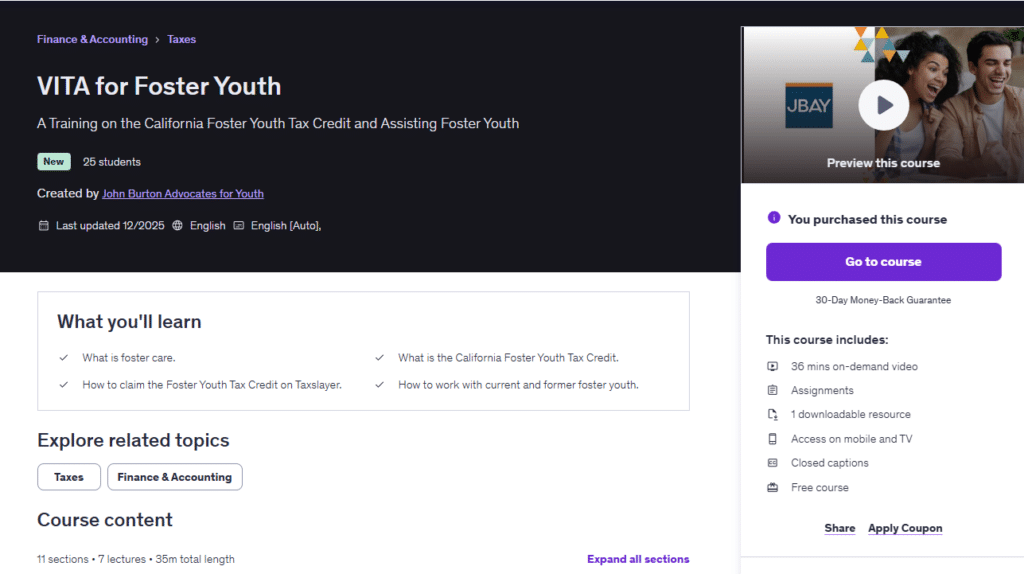

VITA for Foster Youth

A Training on the California Foster Youth Tax Credit and Assisting Foster Youth Clients

This free, virtual, asynchronous course, available on the Udemy platform, is for Volunteer Income Tax Assistance (VITA) site personnel to learn about the California Foster Youth Tax Credit (FYTC) and how to assist current and former foster youth clients.

To take the course, click on the “take the course” button to the right, which will take you to the course’s page on the Udemy website. Once on the Udemy website, click “enroll now.”

The FYTC is a program under the California Earned Income Tax Credit (CalEITC), providing a refundable tax credit to young adults ages 18-25 who were in foster care on or after age 13, and are eligible for the CalEITC. The FYTC was established in California state law in July 2022 and is the first tax credit in the nation specifically for current and former foster youth.

The training course familiarizes VITA volunteers with the foster care system, instructs them how to claim the FYTC in TaxSlayer, and covers common challenges and questions that may arise for young adults from foster care during their VITA appointment. The course also provides links to helpful resources that VITA volunteers may provide to foster youth tax filers to help them prepare for their appointment, and what to expect after filing.